What is a 1031 Tax-Deferred Exchange?

1031 Tax-deferred Exchanges have been around since Congress passed the Revenue Act of 1921. The actual law is found in 26 U.S. Code Section 1031 of the Internal Revenue Code. Under Section 1031, the law specifically states that “a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property.” These transactions are known as a 1031 Tax-Deferred Exchanges. 1031 Exchanges are an excellent wealth-building strategy because it leaves you more money to invest in bigger and better properties. Note, however, that the tax obligation is only deferred, it is not eliminated!

1031 Exchange Process

There are basically four steps in the 1031 Exchange Process.

- You need to decide upfront that you’re going to do a 1031 Exchange. The window for identifying a replacement property is relatively short so making the decision before you sell your property is important. You should also determine who you want to use as a Qualified Intermediary. Most title companies are affiliated with a Qualified Intermediary.

- After you have found some potential properties you may want to purchase, put your property up for sale. The property you are selling is called the relinquished property.

- Identify the replacement properties and put them under contract. You only have 45 days to identify up to three replacement properties. The clock starts ticking the day you close on the sale of your property.

- Close on the purchase the replacement property. You have 180 days from the day you sell the relinquished property to the day you purchase the replacement property. These are calendar days and include weekends and holidays. If you haven’t identified the replacement property within 45 days or closed within 180 days, your 1031 Exchange is disqualified, which means you must pay the taxes on the sale.

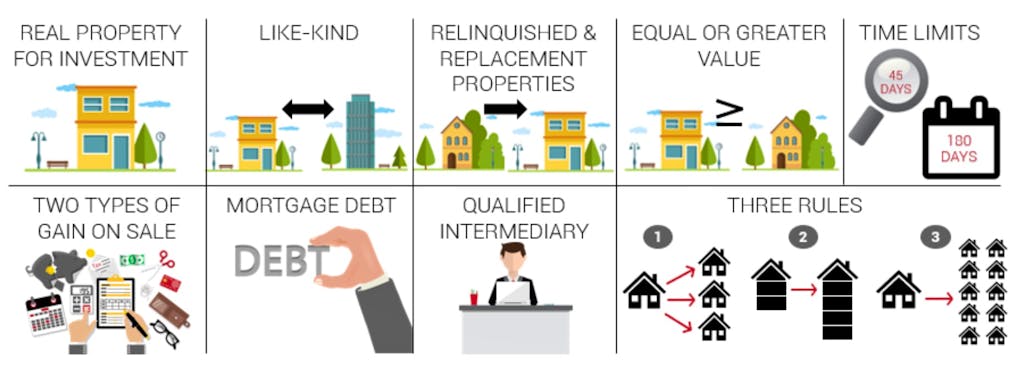

1031 Exchange Rules

There are some important 1031 Exchange rules you must follow. The IRS loves rules! Don’t worry, the tax code gives you some room to be creative. Three things to remember:

- The title to the old property and the title to the new property MUST BE SAME. The owner on title cannot change. For instance, if title is in your personal name, you can’t acquire the new property in the name of an LLC.

- ALL PROCEEDS MUST BE REINVESTED. You can deduct real estate commissions, title, escrow, and exchange fees from the amount you need to invest in the replacement property. Any proceeds you take out at the time of sale, except for the payment of those fees, will be taxed.

- Both the old property, the relinquished property, and the new property, the replacement property, must be “held for investment”. You can’t use the proceeds from the 1031 Exchange to buy a new primary residence or a vacation home. Those are not properties “held for investment” and are disqualified.

The phrase “held for investment” means any property that is acquired and held for income production (meaning for rent or lease) or for growth in value (meaning capital appreciation). Both the relinquished property and the replacement property must be held for investment or for productive use in a trade of business. The law states, “No gain or loss shall be recognized on the exchange of real property held for productive use in a trade or business or for investment if such real property is exchanged solely for real property of “like kind.” The other phrase that stands out in this statement is the term “Like-Kind”.

Like-Kind has been defined as Real property exchanged for real property. In other words, you can’t exchange a rental home for a yacht. Properties are considered “like kind” if they are of the same nature or character, even if they differ in grade or quality. Properties are also considered “like kind” if they are of a like class. Most legal scholars interpret the term “like-kind” as meaning replacing one real estate investment property for another real estate investment property. So, you could replace a single-family rental home with a duplex or land or even for an office building, retail property or industrial property as long as you intend to hold the replacement property for investment. You can even exchange a property held in a business for investment property and vice versa.

Another requirement is that the replacement property must be of “equal or greater value” than the relinquished property sold. That means the replacement property that is purchased MUST be worth as much as or more than the property you just sold. If it isn’t, there will likely be a tax consequence requiring you to pay at least a portion of the capital gain tax owed on the sale.

Here’s a quick example of equal or greater value. Say you sold a single-family rental home for $250,000 and purchased a duplex for $300,000. No problem because the replacement property has a greater value than the relinquished property. On the other hand, if you sold the rental home for $300,000 and bought a duplex for $250,000, you would be required to recognize gain and pay capital gains taxes on $50,000 because the replacement property was not equal to or greater in value than the replacement property.

Sale, Identification, and Purchase

There’s a couple of deadlines that you need to understand with 1031 exchanges. Those deadlines are (1) the identification of a property and (2) purchase of a property. When doing a 1031 exchange, you must identify a replacement property within 45 days of the sale of the 1031 exchange property. You must purchase a replacement property within 180 days of the sale of the 1031 exchange property. When doing a 1031 exchange, circle those dates in your calendar! The IRS isn’t very forgiving to those who miss those their 1031 exchange dates.

Debt on Exchanged Property

Another thing to consider when dealing with 1031 Exchange transactions is the debt associated with the sale. If it’s an “all cash” transaction, then you don’t have to worry about dealing with debt like in our example. If you had debt, meaning a mortgage on the property you sold, to fully defer all capital gains, both the equity and the debt in the new replacement property must be equal to or greater than the equity and debt of the sold property.

Qualified Intermediary

1031 Exchanges are complicated enough that you should not attempt to do these without having expert guidance. Almost every 1031 Exchange is handled by a Qualified Intermediary. A Qualified Intermediary is also known as an Accommodator. This is a company approved by the IRS who is qualified to facilitate 1031 tax-deferred exchange transactions. Make sure you or your client uses a non-related Qualified Intermediary when doing a 1031 Exchange.

Restriction on Number of Properties Identified

The IRS has placed some restrictions on the number of properties which can be identified as potential replacement properties. Because it’s possible to have a sale fall through before you can purchase a property you have identified. The IRS permits you to identify more than one property, as long as certain rules are followed. The three primary rules are shown below.

- Three Property Rule – This is by far the most common rule used when doing a 1031 exchange because it is simple and easy to understand. Under the Three Property Rule, the IRS permits you to identify up to three properties regardless of their fair market values. All identified properties are not required to be purchased to satisfy the exchange; only the number of properties needed to satisfy the value requirement. So, each of the properties you identify could be of equal or greater value or not but, at the end of the day, the properties you purchase must, in total, be of equal or greater value.

- 200% Rule – The 200 Percent Rule states that any number of properties may be specified as long as the aggregate Fair Market Value of all replacement properties does not exceed 200 percent of the aggregate Fair Market Value of all the relinquished properties as of the initial transfer date.

- 95% Rule – The 95 Percent Rule states that any number of replacement properties can be identified as long at the Fair Market Value of the properties actually received by the end of the exchange is at least 95 percent of the aggregate fair market value of all the potential replacement properties identified.

1031 Exchange Review

The basic steps to a 1031 exchange are:

- Sell a property

- Identify a like-kind exchange property of equal or greater value with 45 days.

- Purchase the property within 180 days.

- Save lots of money on taxes!

Why Go to All of the Trouble?

Some of you out there might be thinking to yourselves, 1031 exchanges seem like a lot of work, are they really worth the trouble?! The answer is a resounding YES!

Here’s a final example to illustrate.

Let’s say you sold a couple of rental homes worth $500,000 and are trying to decide if you want to just pay taxes of $100,000 or do a 1031 exchange. You ultimately decide to do a 1031 exchange and come into one of our apartment development projects. The average IRR on those projects are usually around 15% to 20%. Our last deal, Coyote Creek Apartments, was 19% so we’ll use that as an example. You come into a deal like that for $500,000 on a 1031 exchange, earning 19% IRR, over a 5-year period you’re going to have $256,654 more dollars than if you just paid taxes and took the cash! That’s over 50% of the money you put into the project! Now in 5 years when the project is sold, you can take all that extra money and do another 1031 exchange.

DISCLAIMER: NEITHER OVERLAND GROUP OR ANY OF IT’S AFFILIATES PROVIDE TAX ADVICE AND ARE NOT REGISTERED TAX CONSULTANTS. PLEASE CONSULT AN EXPERT WHEN DOING A 1031 EXCHANGE.