High employment and improved consumer spending continues to drive new supply and record demand for U.S. industrial space. According to CoStar managing directors and senior economists Christine Cooper and Abby Corbett, industrial space leasing hit an all-time high of 139 million square feet in the second quarter, outpacing the first quarter by 46%.

In some markets, industrial and retail are merging, placing increased demand on distribution networks. The line between industrial and retail are blurring as companies like Amazon try to position its same day delivery service in closer proximity to the consumer. This demand has reshaped the eCommerce industry. Shifts in the supply chain are causing increased industrial development in markets like Reno, Nevada and Savannah, Georgia, two of the top-growing logistical markets.

With 122 straight months of record setting economic growth, the industrial market has seen demand exceed supply for 9 straight years. Although vacancy rates have risen slightly to 5 percent, some markets have seen vacancy rates at below 4 percent.

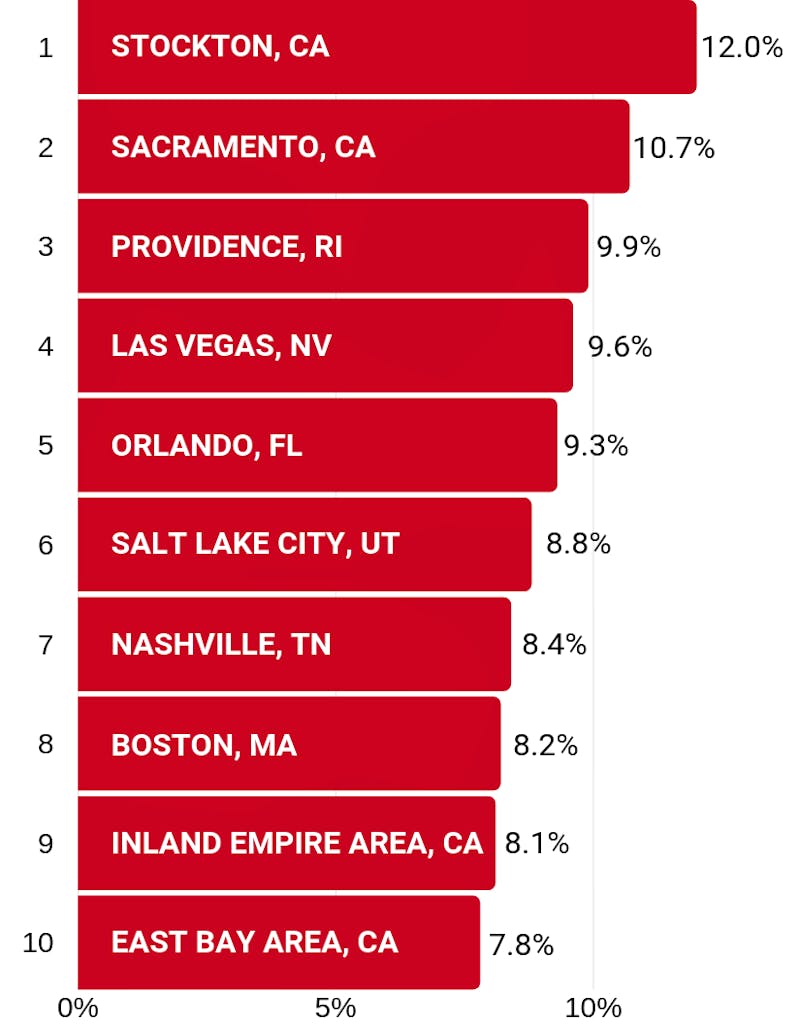

Although rent growth has begun to taper in some markets, the following markets have experienced continued record growth. The top ten markets for rent growth over the past quarter include:

The industrial sector has shown positive leasing fundamentals with rent growth leading all other property types. Although there is continued investor appetite for industrial properties, investors are asking if they can continue to achieve high returns? For most industrial properties, the cap rates have been trending downward, but seems to have stabilized in the 6’s and 7’s, especially for value-add type properties. For larger institutional-grade type properties, these properties have seen cap rates in the sub-4’s and high 3’s. The bottom line is that cap rates have stabilized, but at historic lows.

For investors to continue to achieve high yields, they are eyeing secondary and tertiary markets. Sales prices for industrial property have averaged around $99 per square foot. Over the past year, prices have risen about 7 percent, with some markets seeing prices increase by as much as 10 percent.

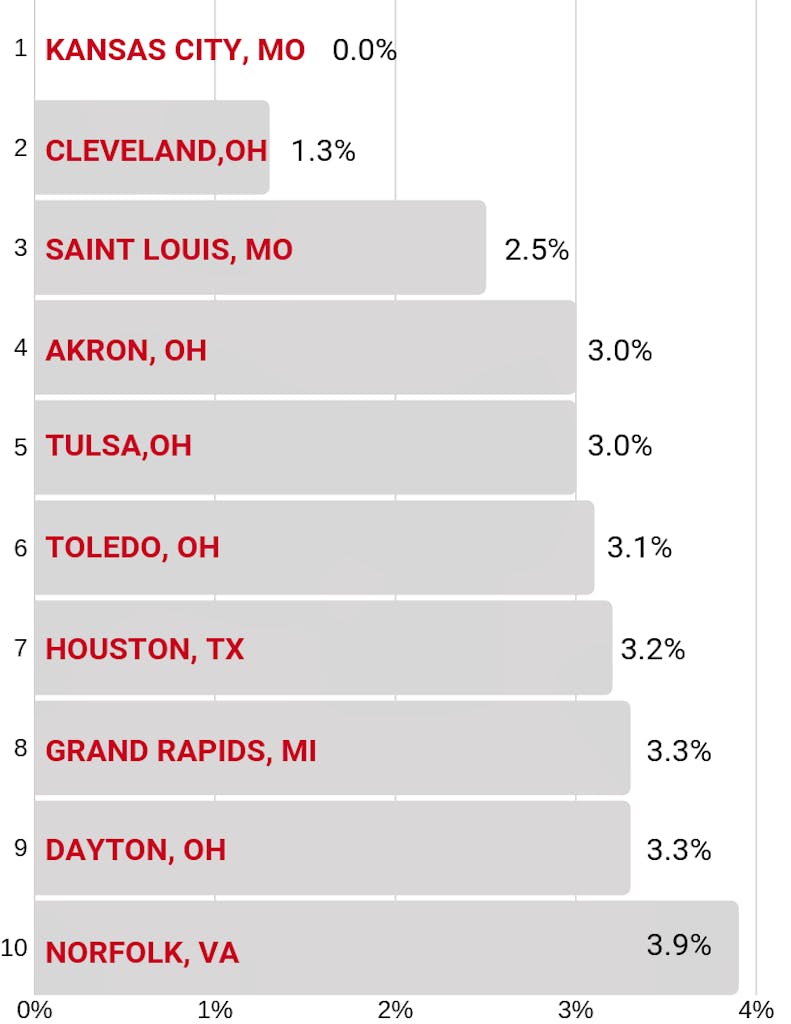

The cities with the weakest rent growth include:

Investors, however, may want to shy away from these markets, all of which have shown weak rent growth compared to other U.S. markets.

Overall, the industrial sector should remain in good health with demand continuing to outpace supply in many markets. The record setting economy and strong employment has driven industrial vacancy rates to 5 percent. If you are an investor considering investing in industrial properties, if you select the right markets you can still expect solid rent growth and appreciating values, although you will likely have to pay more for the property with cap rates compressing to record lows.