Leverage is using borrowed capital (other people’s money) to increase the potential return on an investment. Leverage, if done properly, will significantly enhance your return on investment. This is easy to do if you invest in income-producing real estate but much more difficult, if not impossible, if you’re investing in stocks or mutual funds.

In the stock market, it is difficult to leverage your investment. One dollar buys you a dollar’s worth of stock. Whereas, in real estate, one dollar can buy you four dollars’ worth of real estate because the bank will lend you three of the four dollars you need to purchase the asset.

I once tried to borrow money from a bank on my stock portfolio of blue chip stocks I thought I could borrow money at a low rate of interest and use the money to buy investment-grade real estate. After a lengthy conversation with the bank’s branch manager, I discovered that the bank would only lend up to 50 percent on the stock portfolio’s value and the interest rate they wanted to charge was literally double the going rate on real estate loans.

To make matters worse, they said I would have to hold the stock as collateral and would not be permitted to sell any shares without the bank’s approval. In the end, it made no sense to borrow money on stocks to buy real estate. I discovered that banks view stocks as risky collateral. Here’s how positive real estate leverage works.

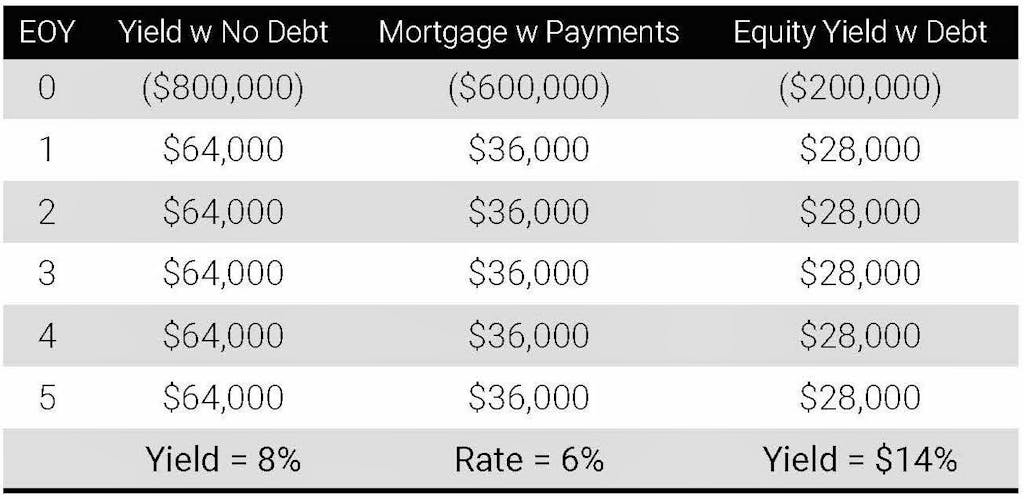

In the example above, if you purchased a property for $800,000 and it provided an annual Net Cash Flow of $64,000, the property yield would be 8% with no debt. On the other hand, if you purchased the same property and obtained a $600,000 loan at 6% interest only, the equity yield would go from 8% without debt to 14% with debt because your total investment would be $200,000 and your annual Net Cash Flow would be $28,000. That’s positive leverage!

Over a 20-year period, the difference in returns can be dramatic. If you purchased $100,000 in mutual funds and they appreciated in value at 6% per year over 20 years, the value would be $320,714 at the end of year 20. If you took the same $100,000 and invested in real estate and it appreciated in value at 6% per year, the value would be $1,282,854. After repaying the loan, the net value would be $1,189,920. That’s a 371% increase in value by investing in real estate.

Next time you’re debating whether to invest in stocks, mutual funds or real estate, remember this example. The right real estate investment can double, triple or quadruple your return over a stock investment by using positive leverage!

Leverage income-producing real estate is a tangible asset that provides safe, predictable high returns compared to other types of investments. Just remember, when buying income-producing real estate, positive leverage is the key to enhanced investment returns.