Capital Stack Intro A real estate capital stack is the financial structure of real estate deal. The capital stack shows the amount and relationship of all the different types of capital used, or expected to be used, in a real estate deal.

While that explanation may seem a little daunting to even the most seasoned investors, it’s actually pretty simple if you break the capital stack into its separate parts.

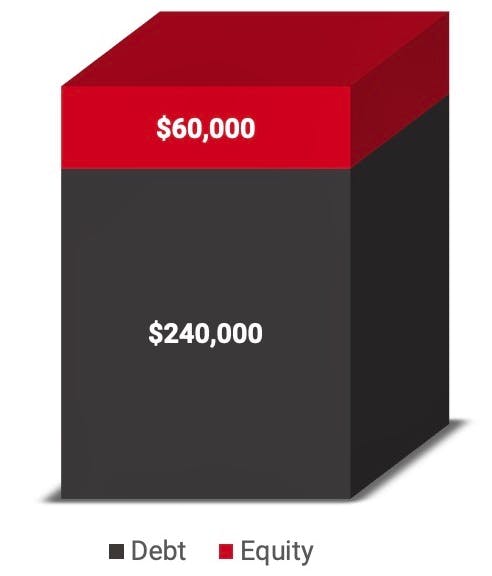

Let’s start with an extremely simple example, your home. If you bought your home for $300,000 and were required to put 20% down, or $60,000, the capital stack on your home would like something like this.

Risk vs. Return along the Capital Stack

The capital stack breaks down the relationship between the debt and the equity. Those at the bottom of the capital have lower risk than those at the top. The capital stack is a continuum so if you were to start at the bottom and move up through the capital stack, the risk goes up each level you go up on the capital stack.

At this point, you’re probably wondering why you would ever want to be anywhere near the top of the capital stack, but that’s where the risk-return relationship comes into play. When a project does well, those at the top of the capital stack enjoy substantially higher returns than those at the bottom of the capital stack. Note that, in general, risk and return are inversely related as you move up and down the capital stack.

Commercial Real Estate Capital Stack

In commercial real estate, there are generally up to four layers of the real estate capital stack.

- Common Equity

- Preferred Equity

- Mezzanine Debt

- Senior Debt

Please note that in most commercial real estate deals, there are only two or three layers that make up the capital stack. Unless it’s an extremely large deal, there is rarely four layers to the capital stack.

Senior Debt

Senior debt is at the bottom of the capital stack because it is the least risky and provides the lowest returns. Senior debt is the least risky because it is secured by the property so if the borrower fails to pay the lender as agreed upon, the lender can take the property from the borrower. Most real estate debt is provided by banks or other financial institutions. The return on senior debt is the lowest of all the capital stack layers and is often fixed or capped at a certain interest rate.

Mezzanine Debt

Mezzanine Debt sits just above senior debt on the capital stack. Mezzanine debt is considered junior debt because it sits behind senior debt in priority of repayment. Because of this, mezzanine debt often has a much higher interest rate than debt. If a commercial real estate investment contains both senior debt and mezzanine debt, those two parties will usually enter into an agreement specifying how the deal will be split up in the event of default. This is often initiated by the senior debt because they don’t want any mezzanine debt trying to take control of an asset they have priority on. As mentioned above, mezzanine debt typically has a much higher interest rate than senior debt, but there return is much lower than equity.

Preferred Equity

Preferred equity is right in between mezzanine debt and common equity. Preferred equity is hard to explain because preferred equity is so flexible. In general, preferred equity is used as a hybrid of common equity and debt, which is why it looks so different depending on the deal. In some commercial real estate transactions, preferred equity looks and acts a lot like common equity. In other commercial real estate deals, preferred equity looks and acts a lot like mezzanine debt. Preferred equity is the least common layer to see in a commercial real estate deal’s capital stack and is usually reserved for large, complex deals.

Common Equity

Common equity is at the top of the commercial real estate capital stack. It is the riskiest because common equity does not receive any money until all other layers of the capital stack have been paid based upon those individual layers’ agreements. That being said, common equity also has the most upside of any of the other layers because they get to enjoy all of the profits once the other layers have been paid off, respectively. Equity investors generally enjoy substantially higher returns than the other layers of the capital stack. In most commercial real estate deals, there is a sponsor or general partner (manager or developer) that contributes a small portion of the equity and is responsible for the management and performance of the actual investment.